UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

Proxy Statement Pursuant to Section 14(a) of the Securities Exchange Act of 1934

Filed by the Registrant þ

Filed by a Party other than the Registrant ¨

Check the appropriate box:

|

| | | | |

| ¨ | Preliminary Proxy Statement |

| |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| þ | Definitive Proxy Statement |

| |

| ¨ | Definitive Additional Materials |

| |

| ¨ | Soliciting Material Pursuant to §240.14a-12 |

Och-Ziff Capital Management Group LLCSCULPTOR CAPITAL MANAGEMENT, INC.

(Name of Registrant as Specified in Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

|

| | | | | | | |

| þ | No fee required. |

| | |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| | |

| ¨ | Fee paid previously with preliminary materials. |

| | |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| (1) | Amount previously paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

SCULPTOR CAPITAL MANAGEMENT, GROUP LLCINC.

NOTICE OF SPECIALANNUAL MEETING OF SHAREHOLDERS

TO BE HELD ON MAY 13, 2019JUNE 24, 2021

Dear Shareholder:

You are invited to a Special Meetingthe annual meeting of Shareholders (the “Special“Annual Meeting”) of Och-ZiffSculptor Capital Management, Group LLCInc. (the “Company”). The SpecialAnnual Meeting will be held solely online on May 13, 2019June 24, 2021 at 11:9:00 a.m. Eastern Time at www.virtualshareholdermeeting.com/OZM2019SMSCU2021. At this Specialthe 2021 Annual Meeting, youthe following items of business will be askedconsidered:

1.The election of Ms. Meghna Desai, Ms. Marcy Engel and Mr. Bharath Srikrishnan as Class II directors to considerserve for a term of three years and vote upon a proposal to approve the adoptionuntil their successors are duly elected or appointed and qualified.

2.Ratification of the second amendment (the “Plan Amendment”) toappointment of Ernst & Young LLP as our independent registered public accounting firm for the Och-Ziff Capital Management Group LLC 2013 Incentive Plan (the “2013 Plan”).year ending December 31, 2021.

The Plan Amendment, which is attached to this proxy statement as Annex A, increases3.Any other business that may properly come before the numberAnnual Meeting or any adjournments or postponements of the Company’s Class A Shares authorized for issuance under the 2013 Plan by a totalAnnual Meeting.

These items of 9,779,446 shares in order to implement the issuance of certain Group E Units (as defined in the proxy statement accompanying this notice) of OZ Management LP, OZ Advisors I LP and OZ Advisors II LP (the “Operating Partnerships”) in connection with the previously announced recapitalization of the Company and its Operating Partnerships. The Company’s Board of Directors believes that the Plan Amendment is in the best interests of the Company’s shareholders and recommends that the shareholders approve the Plan Amendment. The Plan Amendment will not be effective unless approved by the shareholders. The Plan Amendment isbusiness are more fully described in the proxy statement accompanying this Notice.

The Board of Directors has set the close of business on March 18, 2019April 27, 2021 as the record date for determining shareholdersShareholders of the Company entitled to notice of and to vote at the SpecialAnnual Meeting. A list of the shareholdersShareholders as of the record date will be available for inspection by shareholders,Shareholders, for any purpose germane to the SpecialAnnual Meeting, at the Company’s offices and at the offices of American Stock Transfer & Trust Company LLC, the Company’s independent share transfer agent, during normal business hours for a period of 10 days prior to the Special Meeting andAnnual Meeting. The list will also be available for inspection by Shareholders electronically during the SpecialAnnual Meeting at www.virtualshareholdermeeting.com/OZM2019SMSCU2021 when you enter the control number we have provided to you.

All shareholdersShareholders are cordially invited to attend the SpecialAnnual Meeting. EVEN IF YOU CANNOT VIRTUALLY ATTEND THE SPECIALANNUAL MEETING, PLEASE PROMPTLY VOTE YOUR PROXY BY CAREFULLY FOLLOWING THE INSTRUCTIONS ON THE PROXY CARD.

Important Notice Regarding the Availability of Proxy Materials for the

SpecialAnnual Meeting to be Held on May 13, 2019:June 24, 2021: the Proxy Statement and Annual Report

isto Shareholders are Available at www.proxyvote.com

|

| |

| By Order of the Board of Directors, |

| | |

Katrina PagliaDavid Levine |

| Secretary |

April 3, 201928, 2021

New York, New York

TABLE OF CONTENTS

OCH-ZIFF

SCULPTOR CAPITAL MANAGEMENT, GROUP LLCINC.

9 West 57th Street

New York, New York 10019

PROXY STATEMENT

Our board of directors (the “Board of Directors” or the “Board”) is providing these proxy materials to you in connection with the solicitation of proxies by Och-ZiffSculptor Capital Management, Group LLCInc. on behalf of the Board for use at the SpecialAnnual Meeting of Shareholders (the “Special“Annual Meeting”) of Och-ZiffSculptor Capital Management, Group LLC,Inc., which will take place at 11:9:00 a.m. Eastern Time on May 13, 2019,June 24, 2021, and any adjournment or postponement thereof. The SpecialAnnual Meeting will be a completely “virtual meeting” of shareholders. You will be able to virtually attend the SpecialAnnual Meeting, where you will be able to vote electronically and submit questions during the live webcast, by visiting www.virtualshareholdermeeting.com/OZM2019SMSCU2021 and entering the 16-digit control number included in our noticeNotice of Internet availability,Availability of Proxy Materials, on your proxy card or in the voting instructions that accompanies your proxy materials.

The Company intends to make available this proxy statement and the accompanying proxy card on or about April 3, 201928, 2021 to all shareholders entitled to vote at the SpecialAnnual Meeting.

In this proxy statement, references to “Oz Management,“Sculptor Capital,” “our Company,” “the Company,” “the firm,” “we,” “us,” or “our” refer, unless the context requires otherwise, to Och-ZiffSculptor Capital Management, Group LLCInc. (the “Registrant”), a Delaware limited liability company,corporation, and its consolidated subsidiaries, including the OzSculptor Operating Group. References to the “Oz“Charter” refer to our Restated Certificate of Incorporation, dated as of November 5, 2019. References to the “Bylaws” refer to our Amended and Restated Bylaws, effective September 12, 2019.

References to the “Sculptor Operating Group” refer, collectively, to OZ ManagementSculptor Capital LP, a Delaware limited partnership, which we refer to as “OZ Management,” OZSculptor Capital Advisors LP, a Delaware limited partnership, which we refer to as “OZ Advisors I,” OZSculptor Capital Advisors II LP, a Delaware limited partnership, which we refer to as “OZ Advisors II” and each of their consolidated subsidiaries. References to our “Operating Partnerships” refer, collectively, to OZ Management, OZSculptor Capital LP, Sculptor Capital Advisors ILP and OZSculptor Capital Advisors II.II LP. References to our “intermediate holding companies”“Sculptor Corp” refer collectively, to Och-ZiffSculptor Capital Holding Corporation, a Delaware corporation and Och-Ziff Holding LLC, a Delaware limited liability company, both of which are wholly owned subsidiariessubsidiary of Och-ZiffSculptor Capital Management, Group LLC.Inc.

References to our “executive managing directors” refer to the current limited partnersactive executive managing directors of the Oz Operating Group entities, other than our intermediate holding companies, including our founder, Mr. Daniel S. Och,Company, and, except where the context requires otherwise, includealso includes certain limited partnersexecutive managing directors who are no longer active in the business of the Company.our business. References to the ownership of our executive managing directors include the ownership of certain estate and personal planning vehicles, such as family trusts, of such executive managing directors and their immediate family members. References to our “active executive managing directors” refer to executive managing directors who remain active in our business. References to the “Ziffs” refer collectively to Ziff Investors Partnership, L.P. II and certain of its affiliates and control persons.

References to “Class A Shares” refer to our Class A Shares, representing Class A limited liability company interestscommon stock of Oz Management,Sculptor Capital, which are publicly traded and listed on the New York Stock Exchange, which we refer to as the “NYSE.” References to “Class B Shares” refer to Class B Shares of Oz Management,Sculptor Capital, which are not publicly traded, are currently held by our active and former executive managing directors, and have no economic rights but entitle the holders thereof to one vote per share together with the holders of our Class A Shares. References to “Shares” refer to our Class A Shares and Class B Shares, collectively. References to our “shareholders” refer to holders of our Class A Shares and Class B Shares, collectively. The terms “Group A Units,” “Group A-1 Units,” “Group B Units,” “Group D Units,” “Group E Units,” “Group E-1 Units,” “Group E-2 Units” and “Group P Units” refer to the aggregate of interests consisting of one Class A, Class A-1, Class B, Class D, Class E, Class E-1, Class E-2 or Class P, as applicable, common unit in each OzSculptor Operating Group entity, and “Group Unit” or “Unit” refers generally to the aggregate of interests consisting of one common unit of any or all of the Group

A, Group A-1, Group B, Group D, Group E, Group E-1, Group E-2 or Group P common units in each OzSculptor Operating Group

entity. The term “Profit Sharing Interests,” or “PSIs,” refers to non-equity, limited partner profits interests in the OzSculptor Operating Group entities that participate in distributions of future profits of the OzSculptor Operating Group.

AtAs of April 27, 2021, the closeRecord Date for the Annual Meeting, the Class B Shares represent 57.1% of tradingour total combined voting power. Each Class B Shareholder is entitled to one vote per share held of record on January 3, 2019, we effectedall matters submitted to a vote of our shareholders except that Class B Shares that relate to our Group A-1 Units, which represent 11.2% of our total combined voting power, will be voted pro rata in accordance with the previously announced 1-for-10 reverse share split (the “Reverse Share Split”)vote of the Class A Shares. As a resultAccordingly, holders of the Reverse Share Split, every ten issued and outstanding Class A Shares were combined into one Class A Share. Corresponding adjustments were also made to the Class B Shares. ShareShares (other than Class B Shares that relate to our Group A-1 Units) should vote their shares by completing proxies online or by telephone or by mailing their proxy cards, or they may attend and unit amounts presented throughout this proxy statement have been adjusted to give effect tovote via webcast at the Company’s Reverse Share Split.Annual Meeting.

References to our “IPO” refer to our initial public offering of 3.6 million Class A Shares that occurred in November 2007. References to the “2007 Offerings” refer collectively to our IPO and the concurrent private offering of approximately 3.8 million Class A Shares to DIC Sahir Limited, a wholly owned subsidiary of Dubai International Capital LLC, which we refer to as “DIC.” References to the “2011 Offering” refer to our public offering of 3.3 million Class A Shares in November 2011. References to “funds” refer to the multi-strategy, dedicated credit, real estate and other single strategy funds, and other alternative investment vehicles for which we provide asset management services.

No statements made herein, on our website or in any of the materials we file with the United States Securities and Exchange Commission, which we refer to as the “SEC,” constitute, or should be viewed as constituting, an offer of any fund.

Our executive managing directors hold all of our Class B Shares and have granted an irrevocable proxy to vote all of their Class B Shares to the Class B Shareholder Committee, the sole member of which is currently Mr. Och. Mr. Och, who holds approximately 59.4% of the total voting interest in the Company as of March 18, 2019, has agreed, in his capacity as sole member of the Class B Shareholder Committee, to vote in favor of the Plan Amendment. Please be advised that if Mr. Och votes as he has agreed, his vote is sufficient to satisfy the quorum and voting requirements under our Second Amended and Restated Limited Liability Company Agreement dated as of November 13, 2007 (the “Operating Agreement”), and Delaware law, as currently in effect, that are necessary to adopt the Plan Amendment.

QUESTIONS AND ANSWERS ABOUT THESE PROXY MATERIALS AND VOTING

Why am I receiving these materials?

We have made available this proxy statement and proxy card because the Board of Directors of Oz ManagementSculptor Capital is soliciting your proxy to vote at the SpecialAnnual Meeting and at any adjournment or postponement thereof. The SpecialAnnual Meeting will be held on May 13, 2019June 24, 2021 at 11:9:00 a.m. Eastern Time via live webcast through the www.virtualshareholdermeeting.com/OZM2019SMSCU2021. You will need the 16-digit control number provided on the Notice of Internet Availability of Proxy Materials or your proxy card (if applicable). This solicitation is for proxies for use at the SpecialAnnual Meeting or any reconvened meeting after an adjournment or postponement of the SpecialAnnual Meeting.

You are invited to join the SpecialAnnual Meeting and we request that you vote on the proposalproposals described in this proxy statement. However, you do not need to join the SpecialAnnual Meeting to vote your Shares. Instead, you may simply complete, sign and return the proxy card or vote by telephone or Internet, as discussed below.

How are we distributing our proxy materials?

To expedite delivery, reduce our costs and decrease the environmental impact of printing and mailing our proxy materials, we used “Notice and Access” in accordance with an SEC rule that permits us to provide these materials to our shareholders over the Internet. On April 3, 2019,28, 2021, we sent a Notice of Internet Availability of Proxy Materials to certain of our shareholders containing instructions on how to access our proxy materials online. If you received a Notice, you will not receive a printed copy of the proxy materials in the mail unless you specifically request them. Instead, the Notice instructs you on how to access and review all of the important information contained in the proxy materials online. The Notice also instructs you on how you may submit your proxy via the Internet. If you received a Notice and would like to receive a copy of our proxy materials, follow the instructions contained in the Notice to request a paper or email copy on a one-time or ongoing basis. Shareholders who do not receive the Notice will continue to receive either a paper or electronic copy of this proxy statement.statement and our 2020 Annual Report to Shareholders, which was sent on or about April 28, 2021.

Who is entitled to vote at and attend the SpecialAnnual Meeting?

Only shareholders of record of our Shares at the close of business on the record date, March 18, 2019,April 27, 2021, are entitled to receive notice of, to vote at and join the SpecialAnnual Meeting. Each outstanding Class A Share and Class B Share entitles its holder to cast one vote on each matter to be voted upon. Class B Shares that relate to our Group A-1 Units, which represent 11.2% of our total combined voting power, will be voted pro rata in accordance with the vote of the Class A Shares.

What is the difference between Class A Shares and Class B Shares?

The Class A Shares represent Class A limited liability company interestsshares of the Registrant and are listed on the NYSE. The holders of Class A Shares are entitled to one vote per share and any dividends we may pay. The Class A Shares vote together with the Class B Shares on all matters submitted to a vote of shareholders.

The Class B Shares are held by our active and former executive managing directors. They have no economic rights (and therefore no rights to any dividends or distributions we may pay) and are not publicly traded, but rather entitle the holders to one vote per share together with the Class A Shareholders. Class B Shares that relate to our Group A-1 Units, which represent 11.2% of our total combined voting power, will be voted pro rata in accordance with the vote of the Class A Shares. The Class B Shares are intended solely to provide our active and former executive managing directors with voting interests in Oz ManagementSculptor Capital commensurate with their economic interests in the OzSculptor Operating Group. The Class B Shares are not currently and are not expected to be registered for public sale or listed on the NYSE or any other securities exchange.

What is the difference between holding Shares as a shareholder of record and as a beneficial owner?

Most of the holders of our Class A Shares hold their shares beneficially through a broker or other nominee rather than directly in their own name. All of our Class B Shares are held directly by our active and former executive managing directors in their names. As summarized below, there are some distinctions between Shares owned beneficially and those held of record.

Beneficial Owner: If your Class A Shares are held in a brokerage account or by another nominee, you are considered the beneficial owner of Class A Shares held in “street name,” and these proxy materials are being forwarded to you together with a voting instruction card by your broker, trustee or other nominee, as the case may be. As the beneficial owner, you have the right to direct your broker, trustee or other nominee how to vote. The voting instruction card from your broker, trustee or other nominee contains voting instructions for you to use in directing the broker, trustee or other nominee how to vote your Class A Shares.

Because a beneficial owner is not the shareholder of record, you may not electronically vote your Class A Shares at the SpecialAnnual Meeting unless you obtain a “legal proxy” from the broker, trustee or other nominee that holds your Shares giving you the right to vote the Shares at the SpecialAnnual Meeting.

Shareholder of Record: If your Shares are registered directly in your name with us or our share transfer agent, American Stock Transfer & Trust Company LLC, you are considered the shareholder of record with respect to those Shares and these proxy materials are being sent directly to you by the Company. As the shareholder of record, you have the right to grant your voting proxy directly to us or to vote electronically at the SpecialAnnual Meeting. We have enclosed or sent a proxy card for you to use.

What will I need in order to virtually attend the SpecialAnnual Meeting?

You are entitled to attend the virtual SpecialAnnual Meeting only if you were a shareholder of record as of the record date for the SpecialAnnual Meeting, or March 18, 2019April 27, 2021 (the “Record Date”), or you hold a valid proxy for the SpecialAnnual Meeting. You may attend the SpecialAnnual Meeting, vote, and submit a question during the SpecialAnnual Meeting by visiting www.virtualshareholdermeeting.com/OZM2019SMSCU2021 and using your 16-digit control number to enter the meeting.

Shares held in your name as the shareholder of record may be voted electronically during the SpecialAnnual Meeting. Shares for which you are the beneficial owner but not the shareholder of record also may be voted electronically during the SpecialAnnual Meeting. If you are a beneficial owner of Shares held in the name of a broker, trustee or other nominee, you must obtain a “legal proxy,” executed in your favor, from such broker, trustee or other nominee to be able to vote electronically at the SpecialAnnual Meeting. Follow the instructions from your broker, trustee or other nominee included with these proxy materials or contact your broker, trustee or other nominee to request a “legal proxy.” You should allow yourself enough time prior to the SpecialAnnual Meeting to obtain this “legal proxy” from the holder of record.

Even if you plan to virtually attend the SpecialAnnual Meeting, the Company recommends that you vote your shares in advance, so that your vote will be counted if you later decide not to attend the SpecialAnnual Meeting.

What constitutes a quorum?

The presence of a quorum is required for business to be conducted at the SpecialAnnual Meeting. The presence at the SpecialAnnual Meeting, in person or by proxy, of the holders of a majority of our Shares outstanding as of the Record Date and entitled to vote shall constitute a quorum. As of the March 18, 2019April 27, 2021 Record Date, 49,905,35357,618,103 Shares (comprised of 20,446,40124,730,221 Class A Shares and 29,458,95232,887,882 Class B Shares) were outstanding and entitled to vote. If you submit a properly executed proxy card, regardless of whether you abstain from voting, you will be considered in determining the presence of a quorum.

How do I vote my shares?

You may vote via webcast at the SpecialAnnual Meeting or by mail. If you are a holder of record of Shares, you also can choose to vote by telephone or electronically through the Internet. If you hold your Shares in “street name” through a broker, trustee or other nominee, you also may be able to vote by telephone or electronically through the Internet in accordance with the voting instructions provided to you by such broker, trustee or other nominee.

Voting by Mail: If you are a holder of record of Shares and choose to vote by mail, simply complete, sign and date your proxy card and mail it in the accompanying pre-addressed envelope. Proxy cards submitted by mail must be received by our Office of the Secretary prior to the SpecialAnnual Meeting in order for your Shares to be voted. If you hold Shares beneficially in street name and choose to vote by mail, you must complete, sign and date the voting instruction card provided by your broker, trustee or other nominee and mail it in the accompanying pre-addressed envelope within the specified time period.

Voting by Telephone or Internet: If you are a holder of record of Shares, you can choose to vote by telephone or by Internet. You can vote by telephone by calling the toll-free telephone number on your proxy card. The website for Internet voting is listed on the proxy card. Please have your proxy card handy when you call or go online. Telephone and Internet voting facilities for shareholders of record will close at 11:59 p.m. Eastern Time on May 12, 2019.June 23, 2021. If you hold your Shares beneficially in street name, the availability of telephonic or Internet voting will depend on the voting process of your broker, trustee or other nominee. Please check with your broker, trustee or other nominee and follow the voting procedures your broker, trustee or other nominee provides to vote your Shares.

Voting at the SpecialAnnual Meeting: If you are a holder of record of Shares, you may attend and vote via webcast at the SpecialAnnual Meeting. If you are a beneficial owner of Shares held in the name of a broker, trustee or other nominee, you must obtain a “legal proxy,” executed in your favor, from such broker, trustee or other nominee to be able to vote at the Special

Annual Meeting. Follow the instructions from your broker, trustee or other nominee included with these proxy materials or contact your broker, trustee or other nominee to request a “legal proxy.” You should allow yourself enough time prior to the SpecialAnnual Meeting to obtain this “legal proxy” from the holder of record.

Even if you plan to participate virtually at the SpecialAnnual Meeting, we encourage shareholders to vote well before the SpecialAnnual Meeting, by completing proxies online or by telephone, or by mailing their proxy cards. Shareholders can vote via the Internet in advance of or during the meeting. Any vote properly cast at the SpecialAnnual Meeting will supersede any previously submitted proxy or voting instructions. For additional information, please see “Can I change my vote or revoke my proxy after I return my proxy card?” below.

How does the Board recommend I vote on the proposal?proposals?

The Board’s recommendations are set forth after the description of each proposal in this proxy statement. In summary, the Board recommends a vote “FOR”vote:

•“FOR” the approvalelection of the adoption of the second amendment (the “Plan Amendment”)Ms. Meghna Desai, Ms. Marcy Engel and Mr. Bharath Srikrishnan as Class II directors to the Och-Ziff Capital Management Group LLC 2013 Incentive Plan (the “2013 Plan”)serve for three-year terms (see Proposal No. 1); and

•“FOR” the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm for the year ending December 31, 2021 (see Proposal No. 2).

What vote is required to approve each proposal?

Election of Directors. For Proposal No. 1, the election of directors, each Shareholder is entitled to vote for three nominees for Class II director. Directors are elected by a plurality of the votes cast at any duly convened meeting at which a quorum is present. Thus, the three nominees with the greatest number of votes will be elected. Abstentions will have no effect on the election of Class II directors, as they are not counted as votes cast. There is no cumulative voting.

Other Proposals. For Proposal No. 2, the ratification of the appointment of Ernst & Young LLP as our independent registered public accounting firm, a majority of the votes cast will be required for approval. A majority of votes cast means that the number of votes cast “for” must exceed the number of votes cast “against.” Abstentions are not counted as votes “for” or “against” this proposal and thus will have no effect on the outcome of the vote.

Notwithstanding the vote standards described herein, please be advised that Proposal No. 2 is advisory only and will not be binding on the Company or the Board and will not create or imply any change in the fiduciary duties of, or impose any additional fiduciary duty on, the Company or the Board. However, the Board and Audit Committee, as the case may be, will take into account the outcome of the votes when considering what action, if any, should be taken in response to the advisory votes by Shareholders.

A “broker non-vote” would occur only if a broker, trustee or other nominee does not have discretionary authority and has not received instructions with respect to a particular item from the beneficial owner or other person entitled to vote such Shares. Although the determination of whether a broker, bank or other nominee will have discretionary voting power for a particular item is typically determined only after proxy materials are filed with the SEC, we expect that the proposal on ratification of the appointment of our independent registered public accounting firm (Proposal No. 2) will be a routine matter and that the election of each nominee for director (Proposal No. 1) will be a non-routine matter. Accordingly, we expect that brokers will have discretionary voting power to vote Shares for which no voting instructions have been provided by the

beneficial owner with respect to Proposal No. 2. We expect that brokers will not have discretionary voting power to vote Shares with respect to Proposal No. 1, and broker non-votes will have no effect on this proposal, as broker non-votes are not counted as votes cast.

As of April 27, 2021, the Record Date for the Annual Meeting, the Class B Shares represent 57.1% of our total combined voting power. Each Class B Shareholder is entitled to one vote per share held of record on all matters submitted to a vote of our shareholders except that Class B Shares that relate to our Group A-1 Units, which represent 11.2% of our total combined voting power, will be voted pro rata in accordance with the vote of the Class A Shares. Accordingly, holders of Class B Shares (other than Class B Shares that relate to our Group A-1 Units) should vote their shares by completing proxies online or by telephone or by mailing their proxy cards, or they may attend and vote via webcast at the Annual Meeting.

How will my Shares be voted if I do not indicate a vote on my proxy card?card or voting instruction form?

Your Shares will be voted as you indicate on the proxy card or voting instruction form, as applicable. If you return your signed proxy card but do not mark the boxes indicating how you wish to vote, your Shares will be voted as recommended by the Board. See the question above entitled “How does the Board recommend I vote on the proposal?proposals?”

Your Shares will be voted in accordance with the discretion of the proxyholders as to any other matter that is properly presented at the Annual Meeting.

Can I change my vote or revoke my proxy after I return my proxy card?card or voting instruction form?

Yes. Even after you have submitted your proxy, you may change your vote at any time before the proxy is exercised at the SpecialAnnual Meeting. If you are a shareholder of record as of March 18, 2019,April 27, 2021, regardless of the way in which you submitted your original proxy, you may change it by:

•returning a later-dated signed proxy card to us, prior to the SpecialAnnual Meeting, at Och-ZiffSculptor Capital Management, Group LLC,Inc., 9 West 57th Street, New York, New York 10019, Attention: Office of the Secretary;

•delivering a later-dated written notice of revocation to us, prior to the SpecialAnnual Meeting, at Och-ZiffSculptor Capital Management, Group LLC,Inc., 9 West 57th Street, New York, New York 10019, Attention: Office of the Secretary;

•submitting a later-dated proxy by telephone or Internet (only your last telephone or Internet proxy will be counted) prior to the SpecialAnnual Meeting; or

•attending the SpecialAnnual Meeting and properly voting via webcast.

If your Shares are held through a broker, trustee or other nominee, you will need to contact that nominee if you wish to change your voting instructions. You may also vote via webcast at the SpecialAnnual Meeting if you obtain a “legal proxy” as described in the answer to the question above entitled “How do I vote my shares?—Voting at the SpecialAnnual Meeting.”

Mere attendance at the SpecialAnnual Meeting will not cause your previously granted proxy to be revoked.

What vote is required to approvehappens if additional matters are presented at the Plan Amendment?Annual Meeting?

ApprovalOther than the items of the adoption of the Plan Amendment requires approval by a majority of the votes cast. A majority of votes cast means that the number of votes cast “for” must exceed the number of votes cast “against.” Abstentionsbusiness described in this proxy statement, we are not counted as votes “for” or “against” this proposal and thus will have no effect on the outcomeaware of the vote.

Under NYSE rules, the Plan Amendment is not considered a “routine” matter. If you own your Shares in “street name” through a brokerage account orany other nominee, your broker or other nominee will not be permitted to exercise voting discretion with respect to the matterbusiness to be acted upon at the SpecialAnnual Meeting. Thus, ifIf you aregrant a beneficial holder and do not provide specific voting instructions to your broker,proxy, the broker that holds your sharespersons named as proxyholders will not have discretionary authoritythe discretion to vote your Shares on any additional matters properly presented for a vote at the approvalAnnual Meeting or any adjournment or postponement thereof. If, for any reason, our nominees for Class II directors are not available as candidates for director, the persons named as proxyholders will vote your proxy for such other candidates as may be nominated by the Board of Directors, or the Plan Amendment. Accordingly, we encourage you to provide voting instructions to your broker, whether or not you plan to attend the meeting.

Mr. Och, the Chairmansize of the Board holds approximately 59.4% of the total voting interest in the Company as of March 18, 2019. Mr. Och has agreed, in his capacity as sole member of the Class B Shareholder Committee, to vote in favor of the Plan Amendment. Please be advised that if Mr. Och votes as he has agreed, his vote is sufficient to satisfy the quorum

and voting requirements under our Operating Agreement and Delaware law, each as currently in effect, that are necessary to adopt the Plan Amendment.

Can additional matters be presented at the Special Meeting?

No. Pursuant to the Operating Agreement, only business that is described in this proxy statement may be acted upon at the Special Meeting. Accordingly, the Plan Amendment is the only matter thatDirectors will be acted upon at the Special Meeting.reduced.

Who will count the votes?

Representatives of Broadridge Financial Solutions, Inc. will count the votes and act as the inspector of election.

Who will pay for the cost of this proxy solicitation?

We will pay the cost of soliciting proxies. Our directors, officers and other employees, without additional compensation, may solicit proxies personally or in writing, by telephone, e-mail, or otherwise. We are required to request that brokers, trustees and other nominees who hold Shares in their names furnish our proxy materials to the beneficial owners of the Shares, and we must reimburse these brokers, trustees and other nominees for the expenses of doing so in accordance with statutory fee schedules.

PROPOSAL NO. 1

APPROVAL OF THE ADOPTION OF THE PLAN AMENDMENTCORPORATE GOVERNANCE

TO THE OCH-ZIFF CAPITAL MANAGEMENT GROUP LLC 2013 INCENTIVE PLAN

GeneralBoard of Directors

The following information relatesprimary functions of our Board of Directors are to:

•provide oversight, counseling and direction to our management in the interest and for the benefit of our Shareholders;

•monitor senior management’s performance;

•actively oversee risks that could affect our Company;

•oversee and promote the exercise of responsible corporate governance; and

•perform the duties and responsibilities assigned to them under our Charter, Bylaws and other organizational documents, Corporate Governance Guidelines and the laws of Delaware, our state of formation.

Corporate Governance Guidelines

Our Board of Directors has adopted Corporate Governance Guidelines as a framework for the governance of the Company. Our Corporate Governance Guidelines work together with our Charter and Bylaws, which contain certain processes and procedures relating to our corporate governance. Our Corporate Governance Guidelines describe additional processes and procedures that are intended to meet the listing standards of the NYSE and also provide reasonable assurance that our Board of Directors acts in the best interest of our Shareholders. The Corporate Governance Guidelines address issues relating to the recommendationBoard of Directors, such as membership, Board leadership and meetings and procedures, as well as issues relating to the committees of the Board, that shareholders approvesuch as structure, function, charters, membership and responsibilities. The full text of our Corporate Governance Guidelines can be found in the Plan Amendment“Investor Relations— Corporate Governance—Governance Documents” section of our website (www.sculptor.com). A copy may also be obtained upon written request to the 2013 Plan to increase the number of Class A Shares authorized for issuance under the 2013 Plan in order to provide for the issuance of Group E Units, including Group E-1 Units in connection with the recapitalizationus at Sculptor Capital Management, Inc., 9 West 57th Street, New York, New York 10019, Attention: Office of the CompanySecretary.

Director Independence

Under our Corporate Governance Guidelines, a majority of the directors serving on our Board must qualify as independent directors and each of the Oz Operating Group announcedAudit Committee, Compensation Committee, Nominating, Corporate Governance and Conflicts Committee and Committee on December 6, 2018. For additional informationCorporate Responsibility and Compliance must consist solely of independent directors. As described in the Corporate Governance Guidelines, our Board annually (or as circumstances warrant) makes an affirmative determination regarding the recapitalization, see the section below entitled “Recapitalization Transactions” and our Current Report on Form 8-K, filed with the SEC on February 11, 2019.

In connection with the Recapitalization (as defined in the section below entitled “Recapitalization Transactions”), effective as of February 7, 2019, the Board approved the Plan Amendment, subject to and conditioned upon the approval by shareholders, to increase the number of Class A Shares authorized for issuance under the 2013 Plan by a total of 9,779,446 shares in order to provide for the issuance of Group E-1 Units to certain active executive managing directors in the Recapitalization and to provide for future grants of Group E Units to active executive managing directors and new hires. In addition, on February 7, 2019, the Compensation Committee approved the issuance (subject to certain vesting and forfeiture conditions) of an aggregate of 9,655,232 Group E-1 Units under the 2013 Plan to certain active executive managing directors in connection with the Recapitalization. The exchange rights of the holders of Group E-1 Units issued, whereby Group E-1 Units are exchangeable for Class A Shares pursuant to the terms of the Operating Group Limited Partnership Agreements (as defined below), are conditioned upon, among other things, shareholder approval of the Plan Amendment as described in this Proposal No. 1. For details regarding the issuance of Group E-1 Units to our Named Executive Officers, see “Executive and Director Compensation—Compensation Discussion and Analysis—Subsequent Events—Recapitalization.”

The 2013 Plan was originally adopted by our Board and approved by our shareholders on May 7, 2013. On May 9, 2017, the 2013 Plan was amended by the first amendment to the 2013 Plan to increase the number of Class A Shares authorized for issuance under the 2013 Plan by a total of 15,000,000 shares effective May 9, 2017 (“First Amendment”). This proposed Plan Amendment increases the number of Class A Shares authorized for issuance under the 2013 Plan by a total of 9,779,446 shares in order to implement the issuance of certain Group E Units to certain active executive managing directors in connection with the Recapitalization and provide for future grants of Group E Units to active executive managing directors and new hires. As of the Record Date, a total of 24,610,608 Class A Shares were authorized for issuance under the 2013 Plan, with approximately 9,054,259 Class A Shares available for issuance under future grants, excluding the grants of Group E-1 Units described above. Following the approval of Plan Amendment, the number of Class A Shares authorized for issuance will be increased by 9,779,446 shares effective as of February 7, 2019, bringing the total number of Class A Shares authorized for issuance under the 2013 Plan to 34,390,054 shares, of which approximately 9,178,473 shares will remain available for issuance in connection with future awards.

The Company is seeking shareholder approval so that it may grant Group E Units under the 2013 Plan, including the issuance of Group E-1 Units as part of the Recapitalization. The grant of Group E Units, including the issuance of Group E-1 Units (among other actions taken in connection with the Recapitalization), will further promote the retention and motivation of certain executive managing directors and serves to further align such executive managing directors with the Company’s fund investors and Class A Shareholders. Subject to shareholder approval, we plan to register the additional number of 9,779,446 Class A Shares reserved under the 2013 Plan on a Registration Statement on Form S-8.

Dilution and Historical Usage

In evaluating whether to amend the 2013 Plan and determining the number of Class A Shares to request for approval, the Board evaluated the dilution and existing terms of outstanding awards under the 2013 Plan. Prior to the approval of the Plan Amendment (and in all cases excluding the Group E Units, with respect to which the issuance of Class A Shares upon exchange of such Group E Units is subject to shareholder approval of the Plan Amendment), as of February 7, 2019, (i) a total of 24,610,608 Class A Shares were authorized for issuance under the 2013 Plan, with approximately 9,481,298 available for issuance under future grants, and (ii) a total of 58,620,868 Class A Shares were outstanding, assuming the exchange of all outstanding Group Units into Class A Shares and the settlement of all outstanding Class A restricted share units (including performance-based restricted share units) in Class A Shares. Subject to shareholder approval of the Plan Amendment (and in all cases, including the Group Units described above), as of February 7, 2019, (i) there will be 34,390,054 Class A Shares authorized for issuance under the 2013 Plan, of which approximately 9,605,512 will be available for issuance under future

grants, and (ii) an aggregate total of 68,276,100 Class A Shares outstanding, assuming the exchange of all Group Units into Class A Shares and the settlement of all outstanding restricted share units (including performance-based restricted share units) in Class A Shares. The closing trading priceindependence of each Class A Sharedirector. An “independent” director meets both the NYSE’s definition of independence, as ofwell as the record date was $16.23.

Recapitalization Transactions

As previously disclosed, on December 6, 2018, the Company announced that the Company and certain of its subsidiaries, and Daniel S. Och, the Chairman of the Board and its largest shareholder, entered into a letter agreement dated December 5, 2018, providing for the implementation of certain transactions, as set forth in the term sheet attached theretoBoard’s independence standards (the letter agreement, together with the term sheet attached thereto, each as amended on January 14, 2019, on January 31, 2019 and on February 6, 2019 to extend the date for entry into definitive agreements from January 15, 2019 to February 8, 2019 (as amended, the “Letter Agreement”“Director Independence Standards”)). The Letter Agreement provided for, among other things, the preparation and execution of further agreements (the “Implementing Agreements”) and other actions to implement the transactions contemplated by the Letter Agreement (collectively, the “Recapitalization”). On February 7, 2019, the Company and certain of its subsidiaries entered into the Implementing Agreements providing for the consummation of the Recapitalization.

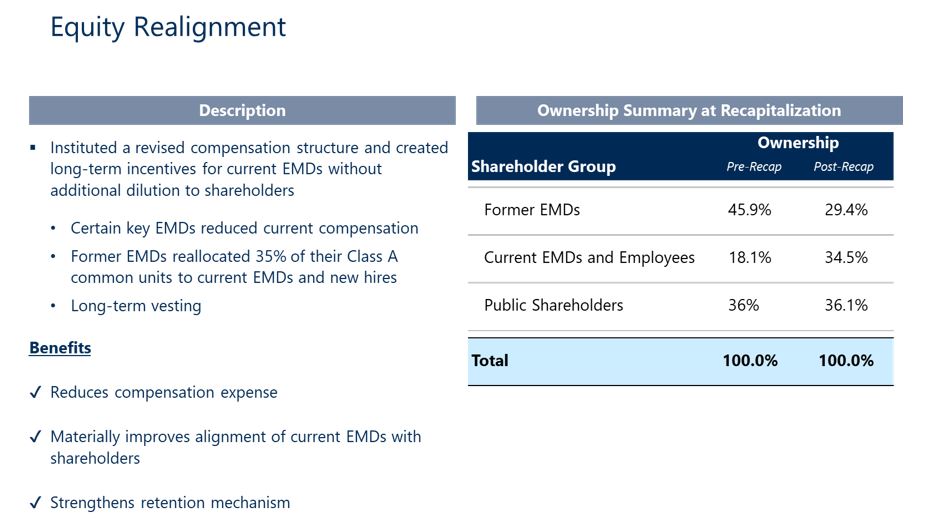

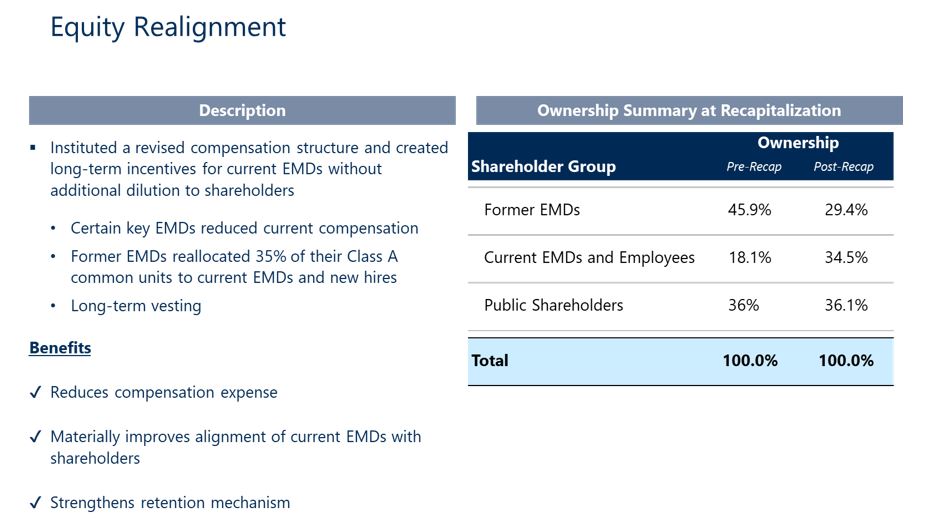

Pursuant to the Recapitalization, among other things, Mr. Och and the other holders of Group A Units in the Operating Partnerships, collectively reallocated 35% of their Group A Units to existing members of senior management and for potential grants to new hires. The reallocation was effected by (i) recapitalizing such Group A Units into Group A-1 Units held by the holders of the Group A Units and (ii) creating and making grants to existing members of senior management (and reserving for future grants to active managing directors and new hires) of Group E Units. The Group A-1 Units will be canceled at such time and to the extent as such Group E Units vest and achieve a book-up. The Group E-1 Units generally vest (i) with respect to Group E-1 Units issued to a limited partner holding Group A-1 Units up to and including the number of Group A-1 Units held by such limited partner immediately following the Recapitalization, on December 31, 2019 and (ii) with respect to all other Group E-1 Units, one-third on each of December 31, 2020, December 31, 2021, and December 31, 2022, provided, that, in each case as determined by the recipient remains in continuous service through each vesting date, subject to accelerated vesting or continued vesting, as applicable, upon the occurrence of certain liquidity events or a qualifying termination of service.

For additional information regarding the Recapitalization, see “Executive and Director Compensation—Compensation Discussion and Analysis—Subsequent Events—Recapitalization.” The exchange rights in respect of Group E-1 Units are subject to shareholder approval of the Plan Amendment.

Terms and Provisions

The material terms and provisions of the 2013 Plan, as amended on May 9, 2017, including the proposed Plan Amendment contained in this Proposal No. 1, are summarized below. This description does not purport to be complete, and is qualifiedBoard in its entirety by reference to the Plan Amendment, a copy of which isbusiness judgment. The Director Independence Standards, attached as Annex A to this proxy statement, are set forth in our Corporate Governance Guidelines and are also available on our website (www.sculptor.com). Our Board undertook its annual review of director independence in April 2021, and in the 2013 Planprocess reviewed the independence of each director. In determining independence, our Board reviews, among other things, whether each director has any material relationship with us. An independent director must not have any material relationship with us, or any relationship that was filedwould interfere with the exercise of independent judgment in carrying out the responsibilities of a director.

Based on the standards set forth by the NYSE and in our Director Independence Standards, the Board has affirmatively determined, after its annual review, that Marcy Engel, David W. Bonanno, Meghna Desai (a Class II Director Nominee), Georganne C. Proctor, J. Morgan Rutman and Bharath Srikrishnan are each independent. James S. Levin and Wayne Cohen are members of management and therefore not independent.

Board Leadership Structure; Executive Sessions of the Independent Directors

Marcy Engel is our Chairperson of the Board, and James Levin is our Chief Executive Officer (“CEO”). Our Bylaws permit the roles of Chairperson and CEO to be filled by the same or different individuals. This allows the Board flexibility to determine whether the two roles should be separated or combined in the future based upon the Company’s needs and the

Board’s assessment of the Company’s leadership from time to time. Our Board periodically reviews the Company’s leadership structure and whether separating or combining the roles of Chairperson and CEO is in the best interests of the Company and its shareholders. When making this determination, the Board will consider any recommendation of the Nominating, Corporate Governance and Conflicts Committee, the current circumstances at the Company, the skills and experiences of the individuals involved and the leadership composition of the Board. Separating the positions of CEO and Chairperson allows our CEO to focus on our day-to-day business, while allowing the Chairperson of the Board to lead the Board in its fundamental role of providing advice to and independent oversight of management.

In addition, our Board, in accordance with our Corporate Governance Guidelines, annually determines whether a Lead Independent Director is necessary and may determine not to designate a Lead Independent Director for so long as Exhibit 10.1the roles of Chairperson of the Board and the Company's Chief Executive Officer are not held by the same individual, or when the Chairperson would not be deemed independent under governing listing standards. The Board has determined that a Lead Independent Director is not necessary at this time.

Pursuant to our Current Report on Form 8-K filed on May 8, 2013,Corporate Governance Guidelines, the independent directors meet in executive sessions, at which the Chairperson presides, without management present at least once every quarter. Following these sessions, the Chairperson of the Board provides management with specific feedback and input regarding information flow, agenda items and any other relevant matters, thereby enhancing the oversight function of the independent directors and the First Amendment to the 2013 Plan that was filed as Exhibit 10.1 to our Current Report on Form 8-K filed on May 9, 2017.

Summarycommittees of the 2013 PlanBoard.

Summary

Committees of the Board

The Board has four standing committees: the Audit Committee, the Compensation Committee, the Nominating, Corporate Governance and Conflicts Committee and the Committee on Corporate Responsibility and Compliance. Our Corporate Governance Guidelines provide that the Board may establish and maintain other committees from time to time, as it deems necessary and appropriate. The following istable provides a summary of the material termsmembership of the 2013 Plan,Board and each of its standing committees as amended, assumingof April 28, 2021. If elected, it is expected that Meghna Desai will join committees immediately after the Plan AmendmentAnnual Meeting.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Director | | Audit Committee | | Nominating,

Corporate

Governance and

Conflicts Committee | | Compensation

Committee | | Committee on Corporate Responsibility and Compliance |

| Marcy Engel | | X | | X | | Chair | | Chair |

| David W. Bonanno | | | | Chair | | X | | X |

Georganne C. Proctor(1) | | Chair(1) | | X | | X | | X |

| J. Morgan Rutman | | | | | | | | |

| Bharath Srikrishnan | | X | | | | | | |

| James S. Levin | | | | | | | | |

| Wayne Cohen | | | | | | | | |

(1) Ms. Proctor is approvednot standing for re-election at the Annual Meeting. A new Chair of the Audit Committee, and a new member of each of the Audit Committee, Nominating, Corporate Governance and Conflicts Committee, Compensation Committee and Committee on Corporate Responsibility and Compliance will be appointed effective immediately after the Annual Meeting.

Each of the four standing committees operate under a written charter adopted by our shareholders. The 2013 Plan was originally adopted on May 7, 2013the Board. For additional information regarding each committee’s duties and amended effective May 9, 2017. Subjectresponsibilities, please refer to the approvalcommittee charters, which are available in the “Investor Relations— Corporate Governance—Governance Documents” section of our shareholderswebsite (www.sculptor.com). Copies of the committee charters may also be obtained upon written request to us at Sculptor Capital Management, Inc., 9 West 57th Street, New York, New York 10019, Attention: Office of the Secretary.

Audit Committee

The primary responsibilities of the Audit Committee are to assist the Board in its oversight of: (i) the integrity of the Company’s financial statements; (ii) the Company’s compliance with legal and regulatory requirements; (iii) the qualifications and independence of the Company’s independent registered public accounting firm; and (iv) the performance

of the Company’s internal audit function and our independent registered public accounting firm. Among its specific duties and responsibilities, the Audit Committee:

•is directly responsible for the appointment, compensation, retention and oversight of the work of the independent registered public accounting firm;

•considers and monitors the independence of the independent registered public accounting firm by:

◦obtaining and reviewing a report by the independent registered public accounting firm which describes any relationships that may reasonably be thought to bear on the independence of such accounting firm;

◦discussing with such accounting firm the potential effects of any such relationships on independence; and

◦obtaining a description of each category of services provided by such accounting firm to the Company together with a list of fees billed for each category;

•reviews and discusses with management and the independent registered public accounting firm our earnings press releases, financial statements and the specific disclosures under “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in the Company’s annual reports on Form 10-K and quarterly reports on Form 10-Q, including any significant financial items and accounting policies or changes relating to such items or policies;

•reviews and discusses with management, our Chief Compliance Officer, our internal auditors and the independent registered public accounting firm their reports regarding the adequacy and effectiveness of our financial reporting process and internal controls, including internal control over financial reporting and disclosure controls and procedures;

•reviews and discusses with management and our internal auditors the scope of and the work performed under our internal audit program and our practices pertaining to risk assessment and risk management;

•reviews significant tax, legal and regulatory matters;

•oversees procedures for handling complaints regarding accounting, internal accounting controls and auditing matters, including procedures for the confidential, anonymous submission of concerns by employees regarding accounting and auditing matters; and

•oversees the Company’s cybersecurity and other information technology risks, controls and procedures, including the Company's plans to mitigate cybersecurity risks and to respond to and potentially disclose cyber incidents.

The Audit Committee operates under a written charter adopted by the Board. For additional information regarding the Audit Committee’s duties and responsibilities, please refer to the Audit Committee Charter, which is available in the “Investor Relations—Corporate Governance—Governance Documents” section of our website (www.sculptor.com). Copies of the Audit Committee Charter may also be obtained upon written request to us at Sculptor Capital Management, Inc., 9 West 57th Street, New York, New York 10019, Attention: Office of the Secretary.

The current members of the Audit Committee are Ms. Engel, Mr. Srikrishnan, and Ms. Proctor. Ms. Proctor currently serves as Chair. Ms. Proctor is not standing for re-election at the SpecialAnnual Meeting. Immediately following the Annual Meeting, our Board of Directors expects to appoint an independent director to the Plan Amendment will become effective asAudit Committee and appoint the Chair of the dateAudit Committee. The Board has determined that each of such approvalMr. Srikrishan and if approved, will continueMs. Proctor is an “Audit Committee Financial Expert” for purposes of SEC rules, as each possesses accounting and related financial management expertise. The Board also has determined in effect until terminated by the Board except as noted below, providedits business judgment that if the Plan Amendment is not approved by our shareholders, the Plan Amendment will not be effective. Mr. Och has agreed, in his capacity as soleeach member of the Class B ShareholderAudit Committee to vote in favoris financially literate, as required by the NYSE. All members of our Audit Committee are independent directors within the meaning of the Director Independence Standards included in the Company’s Corporate Governance Guidelines, the NYSE listing standards and Section 10A(m)(3) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Our Corporate Governance Guidelines and Audit Committee Charter restrict Audit Committee members from simultaneously serving on the

audit committees of more than two other public companies without a specific Board determination that such simultaneous service will not impair the ability of such member to serve on our Audit Committee. Currently, none of the members of the Audit Committee sits on the audit committees of more than two other public companies.

Nominating, Corporate Governance and Conflicts Committee

The primary responsibilities of the Nominating, Corporate Governance and Conflicts Committee are to: (i) identify individuals qualified to become members of our Board; (ii) recommend to the Board director candidates for election at our Annual Meetings; (iii) develop and recommend to our Board a set of corporate governance guidelines; (iv) oversee the evaluation of the Board and its committees; and (v) establish and oversee policies governing conflicts of interest that may arise through related party transactions. Among its specific duties and responsibilities and subject to the agreements described below in “—Selection of Director Nominees,” the Nominating, Corporate Governance and Conflicts Committee:

•establishes processes and procedures for the selection and nomination of directors;

•as part of a fulsome annual self-evaluation process, reviews the size and composition of the Board and its committees and recommends any appropriate changes to the Board;

•recommends to the Board candidates for election or reelection to the Board at each annual meeting of Shareholders;

•periodically reviews our Corporate Governance Guidelines to assess whether they are appropriate for the Company and comply with the requirements of the NYSE and other relevant requirements, and recommends to the Board changes as appropriate to these guidelines; and

•oversees policies and procedures governing related person transactions, periodically reviews and updates as appropriate these policies and procedures and reviews and approves or ratifies any related person transactions, other than related person transactions that are pre-approved pursuant to our Related Person Transaction Policy, described under “Certain Matters and Related Person Transactions—Policy on Transactions and Arrangements with Related Persons.”

The Nominating, Corporate Governance and Conflicts Committee operates under a written charter adopted by the Board. The Committee seeks to have a Board that reflects the appropriate balance of knowledge, experience, skills, expertise and diversity (including, but not limited to, diversity of occupational and personal backgrounds) and considers these criteria when nominating individuals to serve on the Board. The Committee assesses its achievement of diversity through the review of Board composition as part of the Board’s annual self-assessment process. For additional information regarding the Committee’s duties and responsibilities, please refer to the Nominating, Corporate Governance and Conflicts Committee Charter, which is available in the “Investor Relations—Corporate Governance—Governance Documents” section of our website (www.sculptor.com). Copies of the Nominating, Corporate Governance and Conflicts Committee Charter may also be obtained upon written request to us at Sculptor Capital Management, Inc., 9 West 57th Street, New York, New York 10019, Attention: Office of the Secretary.

The current members of the Nominating, Corporate Governance and Conflicts Committee are Ms. Engel, Mr. Bonanno and Ms. Proctor. Mr. Bonanno was appointed as the Chair on April 22, 2021 and currently serves as Chair. Ms. Proctor is not standing for re-election at the Annual Meeting. Immediately following the Annual Meeting, our Board of Directors expects to appoint an independent director to the Nominating, Corporate Governance and Conflicts Committee. All members of our Nominating, Corporate Governance and Conflicts Committee are independent directors within the meaning of the Director Independence Standards, included in the Company’s Corporate Governance Guidelines and the NYSE listing standards.

Compensation Committee

The primary responsibilities of the Compensation Committee are to assist the Board in matters relating to the compensation of our executive officers, employees and directors. Among its specific duties, the Compensation Committee:

•oversees and makes recommendations regarding our overall compensation structure, and policies and practices, and assesses whether our compensation structure establishes appropriate incentives for our executive managing directors, management and employees;

•reviews and approves corporate goals and objectives as relevant to the compensation of the executive officers, and determines and approves, or recommends to the Board, as appropriate, any compensation to be paid to the executive officers;

•oversees our Amended and Restated 2007 Equity Incentive Plan Amendment. If(the “2007 Plan”) and our 2013 Incentive Plan (the “2013 Incentive Plan”) and any other equity-based incentive compensation plans and other compensation and employee benefit plans;

•reviews and discusses with management the Compensation Discussion and Analysis and related disclosures included in our annual proxy statement;

•reviews the compensation of directors for service on our Board and its committees and recommends changes in compensation to our Board, to the extent warranted.

The Compensation Committee operates under a written charter adopted by the Board. For additional information regarding the Committee’s duties and responsibilities, please refer to the Compensation Committee Charter, which is available in the “Investor Relations—Corporate Governance—Governance Documents” section of our website (www.sculptor.com). Copies of the Compensation Committee Charter may also be obtained upon written request to us at Sculptor Capital Management, Inc. 9 West 57th Street, New York, New York 10019, Attention: Office of the Secretary. The Compensation Committee may delegate any of the duties and responsibilities to a subcommittee consisting of not less than two members of the Compensation Committee; the Committee also may delegate any of its duties and responsibilities regarding non-executive compensation to management.

The current members of the Compensation Committee are Ms. Engel, Mr. Och votesBonanno and Ms. Proctor. Ms. Engel was appointed as the Chair on April 22, 2021 and currently serves as Chair. Ms. Proctor is not standing for re-election at the Annual Meeting. Immediately following the Annual Meeting, our Board of Directors expects to appoint an independent director to the Compensation Committee. All members of our Compensation Committee are independent directors within the meaning of the Director Independence Standards included in the Company’s Corporate Governance Guidelines and the NYSE listing standards applicable to compensation committee members and are also “non-employee” directors as defined by Rule 16b-3(b)(3) under the Exchange Act.

Committee on Corporate Responsibility and Compliance

The primary responsibilities of the Committee on Corporate Responsibility and Compliance are to assist the Board in overseeing management’s efforts to ensure a culture of ethical business practices within the Company and to sustain an industry-leading legal and regulatory compliance program. The role of the Committee on Corporate Responsibility and Compliance is one of oversight, recognizing that management is responsible for instilling the Company’s ethics and compliance throughout the Company’s employee base.

The Committee on Corporate Responsibility and Compliance is responsible for overseeing and making recommendations regarding management’s efforts to instill and encourage ethical business practices, and the Company’s legal and regulatory compliance programs.

Among its specific duties and responsibilities relating to the oversight of management’s efforts to ensure a culture of ethical business practices and an industry-leading legal and regulatory compliance program, the Committee on Corporate Responsibility and Compliance:

•reviews and evaluates management’s ethics and culture initiatives, including training on ethical decision-making, to determine if further enhancements are needed to reinforce business practices by employees that are ethical and fully compliant with legal and regulatory requirements;

•reviews and evaluates the Company’s compliance initiatives, including training and the processes for the reporting and resolution of ethics and compliance issues;

•reviews and evaluates management’s efforts to ensure that the Company’s investment decisions reflect the Company’s commitment to ethical business practices and compliance;

•reviews and evaluates internal and external information (including government actions brought in the asset management industry) based on criteria to be developed by the Committee on Corporate Responsibility and Compliance, to assess whether there are significant concerns regarding the Company’s business practices or compliance practices;

•may make recommendations to the Compensation Committee on possible employee compensation actions, such as clawbacks and other remedies, to reward ethical behavior and discourage unethical behavior; and

•reviews the annual report prepared by the Chief Compliance Officer and provides an annual presentation to the Board that includes (i) an assessment of the state of the Company’s compliance functions; (ii) significant compliance issues involving the Company of which the Committee on Corporate Responsibility and Compliance has been made aware, including a summary of the results of any internal investigations conducted by the Company; (iii) any potential patterns of non-compliance identified within the Company; (iv) any significant disciplinary actions against any compliance or internal audit personnel or any Company personnel relating to ethics or compliance matters; and (v) any other issues that may reflect any systemic or widespread problems in compliance or regulatory matters exposing the Company to substantial compliance risk. In advance of such presentation, the Committee on Corporate Responsibility and Compliance and the Audit Committee, either through their respective chairs or otherwise, shall confer on any matters of mutual interest in light of their respective responsibilities.

The Committee on Corporate Responsibility and Compliance operates under a written charter adopted by the Board. For additional information regarding the duties and responsibilities of the Committee on Corporate Responsibility and Compliance, please refer to the Committee on Corporate Responsibility and Compliance Charter, which is available in the “Investor Relations—Corporate Governance—Governance Documents” section of our website (www.sculptor.com). Copies of the Committee on Corporate Responsibility and Compliance Charter may also be obtained upon written request to us at Sculptor Capital Management, Inc., 9 West 57th Street, New York, New York 10019, Attention: Office of the Secretary.

The current members of the Committee on Corporate Responsibility and Compliance are Ms. Engel, Mr. Bonanno, and Ms. Proctor. Ms. Engel serves as the Chair. Ms. Proctor is not standing for re-election at the Annual Meeting. Immediately following the Annual Meeting, our Board of Directors expects to appoint an independent director to the Committee on Corporate Responsibility. All members of the Committee on Corporate Responsibility and Compliance are independent directors within the meaning of the Director Independence Standards, included in the Company’s Corporate Governance Guidelines and the NYSE listing standards.

Board Role in Risk Oversight

Our Board is responsible for overseeing the effectiveness of management’s overall risk management programs and processes and focuses on our overall risk management strategies. Management is responsible for the day-to-day assessment and management of risk and the development and implementation of related mitigation procedures and processes. In exercising this responsibility, management regularly conducts risk assessments of our business and operations, including our funds’ portfolios. Management’s risk management processes cover the full scope of our operations, are global in nature and designed to identify and assess risks as well as determine appropriate ways to mitigate and manage risks. Further, our Risk Committee, which is comprised of members of senior management, oversees portfolio risk management processes. Additionally, our Business Risk Committee, which is also comprised of members of senior management, reviews and evaluates proposed transactions prior to commitment that may present certain risks for our Company, including legal, compliance, reputational or other business risks.

Our Board has delegated to its committees specific risk oversight responsibilities as summarized below. The chairs of the committees report regularly to the Board on the areas of risk they are responsible for overseeing. Further, under our Corporate Governance Guidelines, each of our directors has full and free access to members of the Company’s management and, in accordance with our organizational documents and agreements, may consult with the Company’s management committees. The Board and its committees oversee risks associated with their respective principal areas of focus, summarized as follows:

•The Board as a whole has primary responsibility for overseeing strategic, financial and execution risks associated with the Company’s operations and operating environment, including: (i) significant changes in economic and market conditions worldwide that may pose significant risk to our overall business; (ii) major legal, regulatory and compliance matters that may present material risk to the Company’s operations, plans, prospects or competitive position; (iii) strategic and competitive developments; and (iv) senior management succession planning. The Board reviews information concerning these and other relevant matters that are regularly presented by management, including our Risk Committee, our internal auditors, our Chief Legal Officer and our Chief Compliance Officer, as well as each of the committees of the Board.

•The Audit Committee has primary responsibility for addressing risks relating to financial matters, particularly financial reporting, accounting practices and policies, disclosure controls and procedures, internal control over financial reporting and significant tax, legal and regulatory compliance matters. Our Chief Financial Officer regularly provides reports to the Audit Committee on these matters. Additionally, the Company’s internal auditors report independently to the Audit Committee and our Chief Legal Officer and our Chief Compliance Officer independently report quarterly to the Audit Committee regarding legal matters, compliance matters, and the activities of the Business Risk Committee. In addition, our Board has delegated primary responsibility to the Audit Committee for the oversight of the Company’s cybersecurity and other information technology risks, controls and procedures, including the Company's ongoing monitoring of cybersecurity risks, the implementation of plans to mitigate cybersecurity risks and plans to respond to and potentially disclose cyber incidents. The Audit Committee reports in turn, at least annually, to the Board regarding the Company’s cybersecurity risk management. To assist in performing this oversight function, the Audit Committee receives at least quarterly reports from the Company’s Cybersecurity Risk Oversight Committee. The Cybersecurity Risk Oversight Committee has supervisory responsibilities with respect to the Company’s information technology use and data security, including, but not limited to, enterprise cybersecurity, privacy, data collection and protection and compliance with information security and data protection laws. The Cybersecurity Risk Oversight Committee is committed to evaluating and mitigating cybersecurity risks and, accordingly, is responsible for ensuring that the Company’s information security program and associated internal controls are reasonably designed to provide adequate safeguards to protect against security threats or hazards to our technology systems. The Cybersecurity Risk Oversight Committee meets monthly, is cross-functional and is co-chaired by the Company’s Chief Legal Officer and Chief Technology Officer.

•The Compensation Committee has primary responsibility for addressing risks and exposures associated with the Company’s compensation policies, plans and practices, regarding both executive compensation and the compensation structure generally, including whether it provides appropriate incentives and alignment of interests between our executives and the holders of our Class A Shares. Management has reviewed the Company’s compensation policies and practices for our executive managing directors and employees as they relate to our risk management and reported its findings to the Compensation Committee. The Compensation Committee has concluded that our compensation policies and practices, as described in the section below entitled “Compensation Discussion and Analysis,” encourage and reward prudent business judgment and appropriate risk-taking over the long term and do not create incentives for risk-taking that are reasonably likely to pose material risks to the Company.

•The Nominating, Corporate Governance and Conflicts Committee oversees risks associated with the independence of the Board and potential conflicts of interest.

•The Committee on Corporate Responsibility and Compliance oversees risks associated with our legal and regulatory compliance programs.

Director Attendance at the Annual Meeting and Board and Committee Meetings

Pursuant to our Corporate Governance Guidelines, all of our directors are expected to prepare for, attend and actively participate in all Board meetings and all meetings of any committee of the Board of which they are a member. Also, pursuant to our Corporate Governance Guidelines, our directors are encouraged to attend the Company’s Annual Meetings. All of our then incumbent directors attended the 2020 Annual Meeting. During the year ended December 31, 2020, the Board held 22 meetings, the Audit Committee held seven meetings, the Compensation Committee held thirteen meetings, the Nominating, Corporate Governance and Conflicts Committee held eight meetings and the Committee on Corporate Responsibility and Compliance held five meetings.

During 2020, each then incumbent member of the Board attended 75% or more of the aggregate of the total number of meetings of the Board and the total number of meetings held by committees on which he has agreed, thenor she served during the Plan Amendmentperiod for which he or she was a director or committee member.

Selection of Director Nominees

The Nominating, Corporate Governance and Conflicts Committee makes a recommendation to the full Board as to any persons it believes should be nominated to serve as a member of the Board, and the Board determines the nominees after considering the recommendation and report of the committee. The Nominating, Corporate Governance and Conflicts Committee will consider candidates for Board membership suggested by other members of the Board, management and holders of our Class A Shares. The Nominating, Corporate Governance and Conflicts Committee may retain the services of one or more third-party search firms to assist in identifying and evaluating potential candidates for Board membership. The Nominating, Corporate Governance and Conflicts Committee does not have a formal policy for consideration of director candidates recommended by our Shareholders, as our Corporate Governance Guidelines provide that such candidates will be effective.

The 2013 Plan providesevaluated using the same criteria as candidates recommended by members of our Board or management. Shareholders may recommend any person for consideration as a director nominee by writing to the Nominating, Corporate Governance and Conflicts Committee at Sculptor Capital Management, Inc., 9 West 57th Street, New York, New York 10019, Attention: Office of the Secretary. Recommendations must include the name and address of the Shareholder making the recommendation, a representation that the Shareholder is a holder of our Shares, the full name of and biographical information about the individual recommended, including the individual’s business experience for at least the five previous years and qualifications as a director, and any other information the Shareholder believes would be helpful to the Nominating, Corporate Governance and Conflicts Committee in evaluating the individual recommended.

Once a director candidate is identified, the Nominating, Corporate Governance and Conflicts Committee evaluates the candidate by considering criteria that it deems to be relevant. Although there are no specific minimum qualifications, the criteria evaluated by the Nominating, Corporate Governance and Conflicts Committee may include, among others, business experience and skills, independence, judgment, integrity, diversity, the ability to commit sufficient time and attention to Board activities, and the absence of actual and/or potential conflicts of interest. The Nominating, Corporate Governance and Conflicts Committee considers these criteria in the context of the perceived needs of the Board as a whole at any given time.